Uncertainty Quantification (UQ) involves systematically quantifying uncertainty and variability in both performance models and data. More broadly, uncertainty quantification is a component of uncertainty management – a process that involves identifying, analyzing, understanding, and mitigating uncertainties to support specific modeling or measurement goals. For solar photovoltaic (PV) performance, UQ assesses the effects of model uncertainty (which quantifies potential model error) and input variability (esp. weather) on PV performance metrics.

Why is UQ important?

The financial success of solar projects depends not only on total lifetime energy generation but also on how consistently that generation occurs and the credibility of the underlying performance model. These key aspects are driven respectively by underlying weather variability and model uncertainty. Importantly, due to the time value of energy, not every megawatt-hour generated holds equal economic value for stakeholders. Furthermore, a project’s financing takes place before the project is built; hence, stakeholders have to rely on the model accuracy of the (variable) performance predictions in typical (P50) and downside (P90 or P95 or even P99) cases. Including model uncertainty in assessing performance-variability predictions is critical to accurately assessing and mitigating financial risks associated with solar PV projects.

Project Risk Scenarios

Project performance is evaluated for both typical and downside risk scenarios for protecting the interests of various project stakeholders. UQ provides risk scenarios by a comprehensive analysis of the effects of aleatoric and epistemic uncertainties on predicted energy generation.

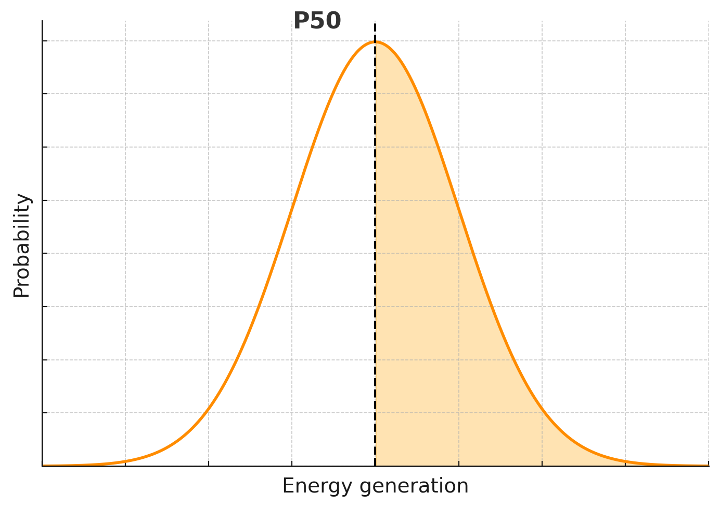

Typical risk scenario

P50 is the 50th percentile (or median) of the probability distribution of predicted annual energy generation, so that 50% of the time, one should expect performance to meet or exceed the P50 value. P50 performance is considered the typical performance-risk scenario, and it is used for calculating the profitability metrics such as the internal rate of return (IRR), net present value (NPV), and multiple of invested capital (MOIC) of the project.

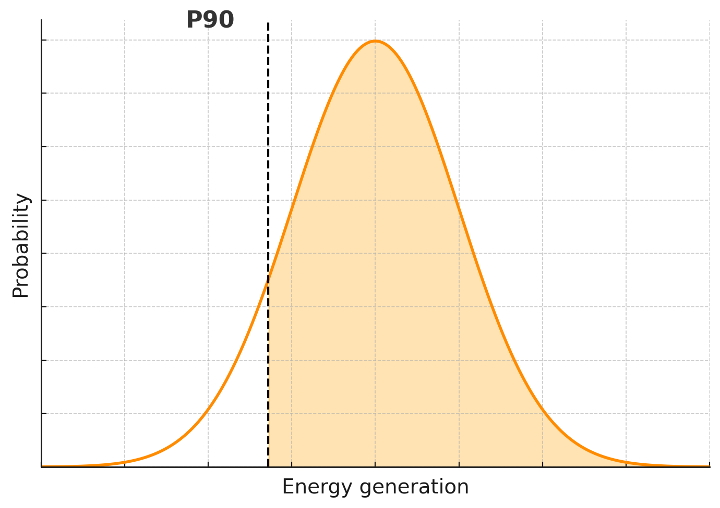

Downside risk scenario

P90 is the 10th percentile of the probability distribution of predicted annual energy generation, so that 90% of the time, one should expect P90 performance or greater. P90 performance is used to guard against rarer, but also more impactful, downside performance-risk scenarios that are used in a project’s financial structuring. Most commonly, the P90 scenario is used to calculate how much debt capital the project can raise. A lower ratio of P90 to P50 (P90/P50) can indicate higher performance uncertainty (project risk), resulting in a lower fraction of debt and thus, a higher net cost of capital and lower project profitability. Depending on the specific project, a higher downside P95, or even P99, performance may be chosen to inform the financial structuring of the project. It is worth noting that highly conservative statistics such as P99 may be harder to estimate accurately due to the long tails of the underlying distribution, especially when there is sampling error or limited historical data. In such cases, the uncertainty in the uncertainty estimate itself becomes significant, and care must be taken in interpreting these extreme percentiles.

Types of Uncertainty

Uncertainties in PV performance modeling can be broadly distinguished in two types: aleatoric, or random uncertainty, and epistemic, or subjective uncertainty. Distinguishing between these types of uncertainty has benefits for the quantification of project risks.

Aleatoric Uncertainty

The aleatoric (random) uncertainty arises from inherent randomness or natural variability within the PV system or environmental factors. It cannot be reduced through additional information or measurement but is typically expected to show trends over the long term. For example, the future solar resource can be expected to have natural year-to-year fluctuations driven by weather phenomena such as El Niño which cannot be known with certainty. Some years may experience higher-than-average insolation, while others may fall below historical averages.

Epistemic Uncertainty

Epistemic (systemic) uncertainty stems from incomplete knowledge, limited data, or inaccuracies within modeling approaches. Unlike aleatoric uncertainty, epistemic uncertainty can (in concept at least) be reduced through improved measurement techniques, data collection, equipment calibration, or more sophisticated modeling. An example is the uncertainty in a module’s rated power. Uncertainty in the nominal value from a manufacturer’s datasheet can be reduced by flash testing module samples.

It’s worth noting that the distinction between aleatoric and epistemic uncertainty can depend on modeling choices and the available data. For instance, inverter outages can be treated as random events with random properties such as duration (aleatoric), modeled deterministically with an uncertain annual loss factor (epistemic), or represented as a random process (aleatoric) described by parameters with epistemic uncertainty, such as an uncertain rate of occurrence.

Advantages of Distinguishing Aleatoric and Epistemic Uncertainties

Conventionally, P50 and P90 values summarize the combined effect of both aleatoric uncertainty, due to natural resource variability, and epistemic uncertainty, which arises from model error or incomplete knowledge. Distinguishing between these two sources of uncertainty offer practical benefits.

- Quantifying Return on Investment (ROI) in Model Improvement and Data Collection: Isolating epistemic uncertainty allows stakeholders to evaluate the potential benefit of improving models, measurements, or data quality. Reducing epistemic uncertainty through such targeted investments can yield measurable improvements in the project IRR and confidence in it.

- Stakeholder-Specific Risk Profiles: For geographically diverse project portfolios, weather-related risk (aleatoric) tends to average out over the portfolio’s lifetime, reducing its overall financial impact. In contrast, model-related uncertainty (epistemic) does not benefit from such diversification and may persist consistently across assets. This presents a systemic risk, particularly for stakeholders with ownership interests or contractual obligations tied to generation thresholds, emphasizing the importance of minimizing epistemic uncertainty through improved modeling and data practices.

Content for this page was provided by Chetan Chaudhari (PowerUQ), Mark Campanelli (PowerUQ) and reviewed by Keith McIntosh (PV Lighthouse – SunSolve), Cliff Hansen (Sandia National Laboratories) – 2025